Las Vegas money isn’t betting on a speedy economic recovery, I suspect. Self-sustaining growth doesn’t seem in the cards. If anything, the results of last week’s elections probably lengthened the odds.

Here’s why.

The economy shows few signs of vigor. Economic growth is anemic and official unemployment is stuck at 10 percent. Wages are in a rut, but employers, still not satisfied with their bottom line (are they ever?), are insisting on concessions from their employees.

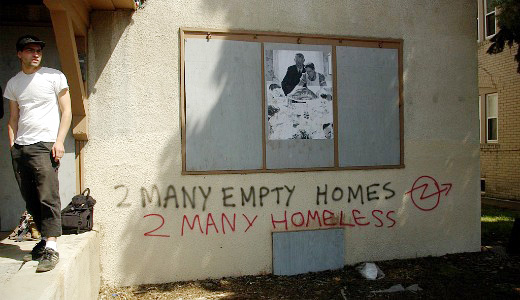

Consumer spending is stalled as millions of people struggle to pay down their accumulated debt. Home sales and prices continue to fall, while foreclosures are increasing, thanks in no small measure to the refusal of banks to renegotiate mortgage terms.

Export markets aren’t much help either. And little change is expected, even if the dollar slides in value compared to other currencies, for the simple reason that world economic growth remains slow too.

In contrast to the previous two global slowdowns, no bubbles are on the horizon and no country has the capacity to reinvigorate the world economy as the U.S. – mainly by means of speculative bubbles and unsustainable debt – did in the 1990s and most of this decade.

Meanwhile, the top 1 percent of Americans who account for almost 40 percent of all wealth are doing quite well, and the top corporate elites are sitting on $2 trillion of cash, which they only dip into to chase speculative investment opportunities abroad.

What makes this seemingly intractable situation worse is that the government’s traditional anti-cyclical tools – fiscal and monetary policy – are ineffective, but for different reasons.

The Federal Reserve Bank entered the security and bond markets last week, thereby pushing down interest rates and pouring money into the economy. This will help, but its positive impact is limited by the fact that interests rates were already close to zero. Pushing them further down, while necessary in these circumstances, won’t throw the economy on a self-sustaining growth trajectory.

As for fiscal policy, Republican obstructionism has crippled its potential as a counter-recessionary tool. The Republicans reject out of hand even modest government spending on jobs, infrastructure, education and aid to strapped state and local governments – not to mention a second stimulus bill which, if large enough, would stand a chance of reinvigorating the economy and reducing unemployment.

A sour, stagnant economy suits the Republican right. In fact, a faltering economy and the bulging deficits that accompany it are the Republicans’ “field of dreams” – giving them an opportunity, they believe, to slash, burn and privatize public sector jobs and, at the same time, win the presidency and control of both chambers of Congress in 2012.

Wall Street doesn’t hurt when Main Street bleeds either. In fact, if statistics don’t lie, Wall Street profits, bonuses, perks and structural dominance continue with hardly a blip.

Contrary to conventional thinking, capitalists can keep accumulating capital (for profit-taking) in a slowing, even stagnant economy. A fast-growing, dynamic economy is not a necessary condition for profitability for the corporate exploiters of wage labor or speculators of fictitious capital (capital with no underlying value).

They may prefer one or the other – growth or stagnation – at a particular moment, but it depends on the political and economic conditions at that moment.

For now anyway, the comfort level of the main sections of capital, much like right-wing extremism that does its bidding, is with a slow-growth economy.

This sounds grim for American workers, especially in the wake of last week’s elections. But before anyone throws up their hands, keep in mind that the elections were a setback, but not a complete defeat. The people’s coalition retains bases of power to fight from and the political prospects going forward are better than they were in 1994 when the Republican right, fresh from its sweeping victory in the mid-term elections (both chambers of Congress went Republican), proclaimed the beginnings of a social revolution to scale back government and its social obligations.

History tells us they failed, and, of course, regaining the high ground and initiative in current circumstances won’t be easy. But it can be done. But only if we build broad democratic unity, energize the grass roots, reject the mistaken and dangerous notion that the president and his party are the main obstacle to progress, embrace broad strategic and tactical concepts of struggle, and, above all, take action.

Photo: An empty home in Minneapolis. Andrew Ciscel CC 2.0

MOST POPULAR TODAY

High Court essentially bans demonstrations, freedom of assembly in Deep South

U.S. imperialism’s ‘ironclad’ support for Israel increases fascist danger at home

Zionist organizations leading campaign to stop ceasefire resolutions in D.C. area

UN warns that Israel is still blocking humanitarian aid to Gaza

Comments