SAN FRANCISCO, Mar 20 (IPS) – Thousands of angry U.S. workers took to the streets Thursday to protest some major banks and insurance companies that have handed out extravagant bonuses on the taxpayers’ dime, as the U.S. House of Representatives voted to get some of the bonus money back.

‘Banks get bailed out and people get sold out!’ yelled janitors, hotel workers, security workers and others pounding on makeshift drums outside a Wells Fargo bank in San Francisco.

The protesters, from ACORN, Catholics United, Jobs with Justice, the powerful Service Employees International Union (SEIU) and other groups marched in Boston, Chicago, Denver, New York and other cities. The actions were aimed at raising support for strong banking reform, the right to unionise and health care for all. Some also marked the sixth anniversary of the start of the Iraq war.

‘We’re not about to let up until we see effective change in San Francisco, Sacramento [California’s state capital] and Washington, D.C.,’ Matt Roberts, a security officer and SEIU member, told IPS.

Rev. Israel Alvaron, of Clergy and Laity United for Economic Justice, marched in front of the San Francisco Wells Fargo in solidarity with hotel and restaurant workers in the Bay Area whose employers, including Hyatt and Meridian, are discouraging them from unionising.

‘Wells Fargo is a client of the hotels. That’s why I’m here,’ Alvaron told IPS.

Roberts said Wells Fargo and other banks are taking taxpayer dollars with one hand and with the other, are lobbying against a bill in Congress that would remove barriers to unionising, called the Employee Free Choice Act.

‘We’re absolutely opposed to AIG [American International Group] getting multi-million-dollar bonuses,’ Roberts added.

Wells Fargo paid its CEO 26 million dollars in 2007 and paid its bank tellers about 21,000 dollars, SEIU says. The bank has increased its fees on consumers by almost 30 percent since 2003. It spent 690,000 dollars on lobbying in just the last three months of 2008, SEIU says. The protests came just days after the public learned that AIG, a global insurance firm, handed out 165 million dollars in bonuses to its top employees on Mar. 13.

The ailing company has so far received 173 billion dollars in taxpayer assistance to keep it and major banks from a total collapse. U.S. taxpayers gained 80 percent of the company in exchange for the funds, but the deal has been widely criticised because the U.S. has no shareholder voting rights and no representation on the company’s board.

AIG is in bad shape because it insured the risky trades of major banks, trades of exotic products, called credit default swaps, derived from questionable, high-interest mortgages held by banks. More than 2 million mortgages have since gone belly up.

Many banks now want to cash in on their insurance and AIG says it is out of cash.

New York Attorney General Andrew Cuomo subpoenaed AIG and learned that the company paid bonuses to 417 employees and that 298 were paid more than 100,000 dollars. More than 50 people were paid 1 million dollars each. Eleven of those who were given bonuses are no longer with AIG.

‘I know 165 million is a very large number,’ AIG CEO Edward Liddy told the House Finanical Services Committee on Wednesday. ‘We thought it was a good trade,’ for the work the company has done to reduce its debt, he said.

AIG is just one of more than a dozen major banks that have received huge infusions of bailout cash from the U.S. Treasury, and that then attempted to hand out hefty bonuses to CEOs. Some halted the bonuses, under public pressure.

Merrill Lynch is expected to hand over its bonus information soon to Cuomo.

According to a recent report by the Institute for Policy Studies, Wall Street firms handed out 18 billion dollars in bonuses in 2008.

An angry congressional panel questioned AIG CEO Edward Liddy on Wednesday about the bonuses.

Thursday, the House passed a bill that would strip 90 percent of the bonus amounts, by heavily taxing them.

The taxes would only apply to people whose family income is 250,000 dollars or more, who received bonuses in 2009 and who work at one of the dozen or so banks bailed out by 5 billion dollars or more,, including Bank of America Corp., Citigroup Inc., Goldman Sachs Group Inc., J.P. Morgan Chase & Co., Morgan Stanley and the mortgage agencies, Fannie Mae and Freddie Mac.

The House bill was passed by 243 Democrats and 85 Republicans, and six Democrats and 87 Republicans voted against it. A similar bill is expected to pass the Senate soon and be signed into law by Pres. Barack Obama.

‘Today’s vote rightly reflects the outrage that so many feel over the lavish bonuses that AIG provided its employees at the expense of the taxpayers who have kept this failed company afloat,’ Obama said Thursday. ‘I look forward to receiving a final product that will serve as a strong signal to the executives who run these firms that such compensation will not be tolerated.’

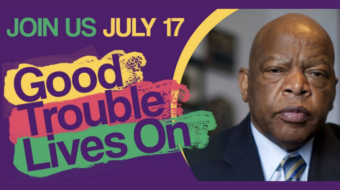

Meanwhile, Rep. John Lewis, said Thursday that his research shows that at least 13 firms that have received the biggest bailouts owe more than 220 million dollars in back taxes – a violation of the contract they signed with the U.S. Treasury.

‘Are they signing contracts knowing that they owe taxes but thinking they will not get caught?’ Lewis said during a House subcommittee hearing. ‘Did then-secretary Paulson turn a blind eye? Either way, this is shameful. It is a disgrace.’

‘Taxpayers have no sense that there is any control over this money. They have no idea what, if anything, they will get in return. This entire programme is based on trust – trust in the givers and trust in the takers. At this point, there is no trust,’ Lewis said.

A controversy has erupted within the Barack Obama administration about the bonuses, and who knew about them.

Special Inspector General Neil Barofsky told the House Financial Services Committee Thursday that the Bush administration’s Treasury Department and AIG negotiated the bonuses in November 2008.

And AIG says it also gave notice last year to the Security and Exchange Commission that it planned to handout bonuses in 2009, and then told the New York Federal Reserve in January about the bonuses, led Timothy Geithner, since appointed head of the U.S. Treasury.

Neither the commission nor Geithner intervened or gave a heads up to President Barack Obama of the bonuses. Geithner has said he learned that the bonuses were going to be made on March 10 and that he couldn’t stop them. Obama was told Mar. 12 of the impending bonuses, Geithner says.